Financial Modelling with Python

Python, a versatile and powerful programming language, has made significant inroads into the financial industry in recent years. Its simplicity, readability, and extensive libraries have made it a preferred tool among financial analysts and quantitative researchers. Personally, I have dedicated thousands of hours to using Python for both individual projects and institutional applications.

Through this experience, I’ve developed a solid understanding of designing financially sophisticated models and algorithms, focusing on creating structures that are robust, effective, and easily maintainable. Maintaining models, ensuring they handle new data effectively, and adapting them to changing situations are areas where I’ve made mistakes and learned valuable lessons. These pages aim to share my knowledge and experience, helping you learn from my journey and potentially avoid similar pitfalls.

This financial modeling guide provides information on getting started with Python, setting up a project, and structuring, building, and testing a model. Here, I share practices that have proven effective, drawing from my experiences across various roles. You can navigate the content using the sidebar on the left or the buttons below, which are available on every page.

Financial Literature

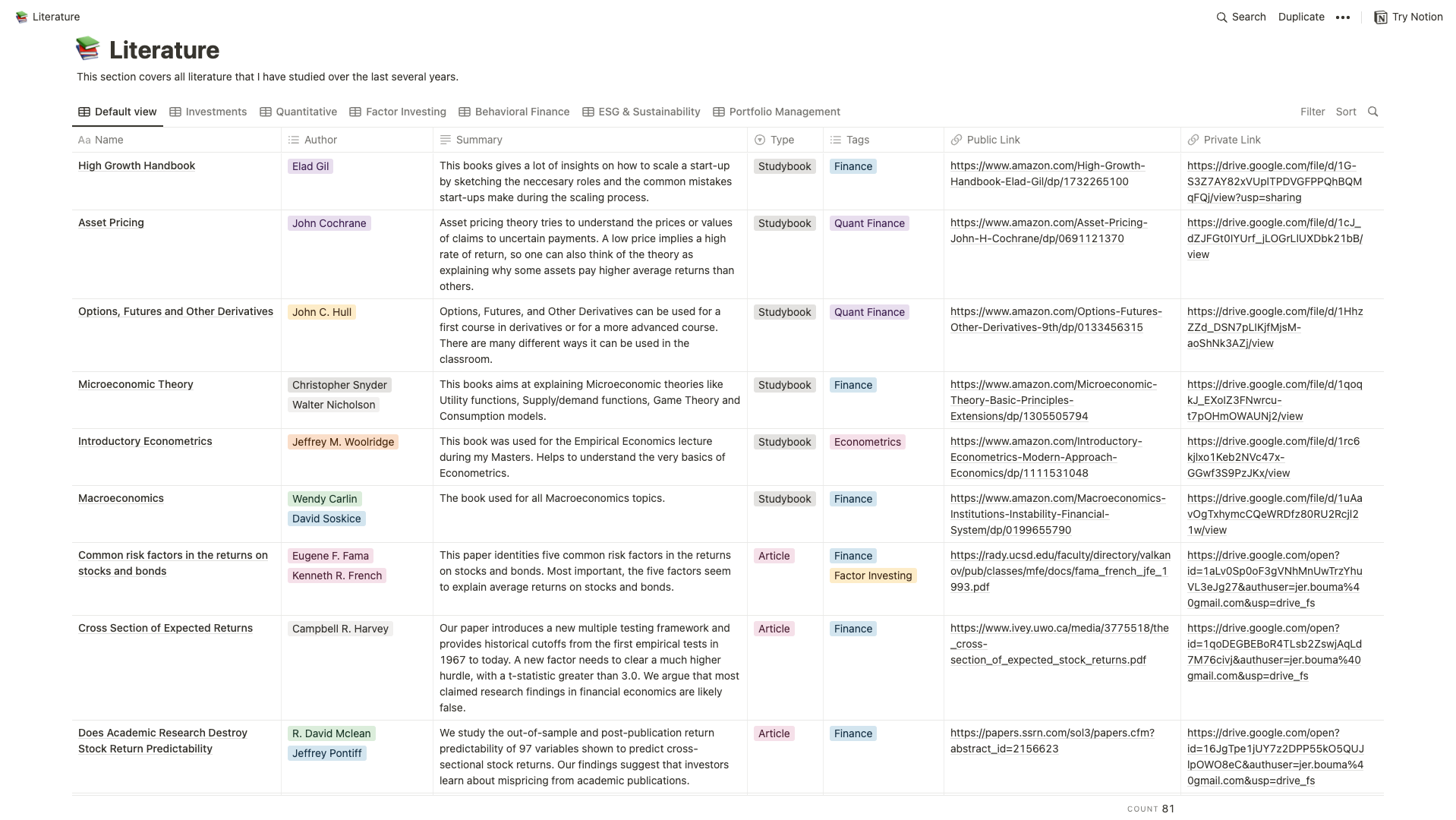

Most of the modeling I undertake is grounded in established financial literature. The Notion page linked below serves as my repository for articles and papers that capture my interest, primarily focusing on investing, economics, and behavioral finance. I strive to include public links within the page, allowing easy access to the documents for further reading.

Visit My Notion Page

Have suggestions? This entire website is open-source, so feel free to contribute here!